|

| CMP = 90 |

Asian Energy Services Limited (ASIAN) (formerly Asian Oilfield Services Limited) is an oil, gas and mineral industry service provider.

In May 2016, there was big turnaround in the fortune of this company came when Oilmax Energy has acquired the company from its previous promoter PE firm Samara Capital. In fact Samara capital has exited the company with loss due to lack of required experience in oil and gas exploration industry.

https://www.bseindia.com/xml-data/corpfiling/CorpAttachment/2016/11/677CD8C6_3193_447E_BF12_FC2C6FF88144_182627.pdf

Later on company has raised the fund by issuing preferential basis shares @ Rs 80 and Rs 165 to promoters and other public category individual investors.

https://www.bseindia.com/xml-data/corpfiling/CorpAttachment/2016/12/34CB24C7_A53F_49F6_ABF7_BBB0481E935E_123747.pdf

https://www.bseindia.com/xml-data/corpfiling/CorpAttachment/2017/3/dc356743-3255-4bb7-acdf-dd584fa96da7.pdf

Post takeover by Oilmax, Asian has diversified its service portfolio and start offering end-to-end services which extend across the entire upstream value chain, including Geophysical Data Acquisition, Production Facility EPC using the Build-Own-Operate-Transfer (BOOT) model, Turnkey Drilling, and production facility Operation and Maintenance.

The company is specialised in 2D and 3D seismic data acquisition and entire spectrum of seismic and related services including acquisition, processing and interpretation of seismic data. It has exclusive access to wireless technology for seismic data collection in India.

Investment Rationale

Asian has competitive advantage over its competitor on cost and quality. It also allow this company to protect and maintain its market share with good profitability. All over the world Oil and gas exploration is dominated by multinational companies like Schlumberger, Halliburton, Baker and Hughes etc. Asian is Indian MNC which is providing its services in several countries.

People are the biggest asset for this company which make the whole difference. Promoters and management team are having very vast experience in Oil and gas exploration industry with all major domestic and global companies. Company has healthy business relationships with its clients such as Oil and Natural Gas Corporation Ltd (ONGC), Oil India Ltd (OIL), Vedanta etc.

It has very dynamic board of directors which include industry legends like Dr. Rabi Bastia, a globally acclaimed geoscientist, has been the driving force behind the rapid advancement of India in the oil industry. He is best known for his discovery of the KG D-6 gas field, the second largest find in the country till date. In 2007, Dr. Rabi Bastia was awarded the Padma Shri. It is rare instance that one of India's top civilian awards being given to a private sector executive.

An incredible tale of innovations in the Oil Industry - Dr. Rabi Bastia

https://youtu.be/dr_jAvDmwAE

ASIAN has an impeccable track record of delivering projects on time and in a cost-effective manner, in some of the most challenging environments such as arid deserts, forests and steep mountainous terrains, all the way from deserts in Kurdistan to the wet, hilly, forests in Assam

ASIAN being the only company to offer 3D wireless seismic technology in the Indian market. It provides comprehensive global resources onshore seismic data acquisition. Cable-less recording technology point-receiver seismic hardware and software enables a full range of imaging services, from cost-effective exploration through to high-quality imaging and reservoir characterization.

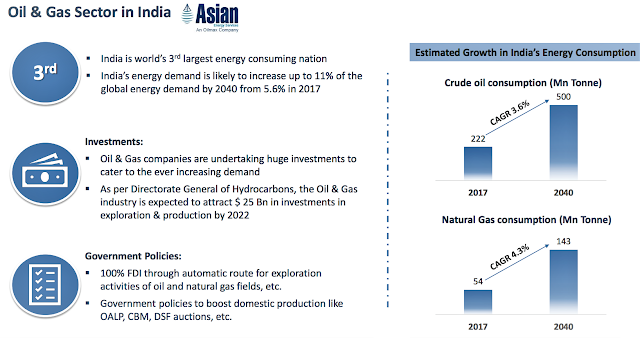

India is the world’s third largest energy consumer globally. The Indian Government has already unveiled of the National Seismic Program (NSP) to appraise the country’s reserves, the Indian seismic market has been expanded greatly with ~Rs 5000 Crore of work on offer.

Diesel demand in India is expected to double to 163 MT by 2029-30. Consumption of natural gas in India will increase by more than three-folds in next 10 years. The industry is expected to attract US$ 25 billion investment in exploration and production by 2022.

https://www.ibef.org/download/Oil-and-Gas-November-2020.pdf

The future for the O&M vertical look promising, with extensions on current orders and negotiation for more orders currently in the works. Even in a low oil price scenario, ASIAN should continue to see growth in the O&M vertical, as it specialize in being low-cost operators.

Asian has current order book of above Rs 1000 Crore Which gives fair business visibility for next three years. Even in dull market conditions order flow continues from major oil companies in India.

https://www.asianenergy.com/pdf/Investor-Relations/Corporate-Announcements/OtherCorporateAnnouncements/LOA-from-OIL-NC-Hills.pdf

https://www.asianenergy.com/pdf/Investor-Relations/Corporate-Announcements/OtherCorporateAnnouncements/BSE-Announcement-ONGC-Award%2026.10.2020.pdf

The company become debt free through repayment of corporate loans and outstanding liabilities, and to get rid of any deadweight, by selling off any non-strategic assets, to clean up its balance sheet.

Asian is run by a very highly qualified management team composed of industry veterans and pioneers, with an average experience of over 35 years working in the industry. The focus under the new management team is to be low-cost operation and maintaining the rigorous standards of quality and performance for its all services on offer. Going forward, company aims to switch from a capital-intensive business model to one in which it avoids owning assets where possible, to keep its capital risk as low as possible.

Expansion into offering other services like EPC, drilling, and decommissioning, is strategically focused on de-risking the revenue streams. Moreover, it allows the company to offer low-cost integrated management solutions to the Indian and international market.

Conclusion

Company has already made big turnaround within few years after acquisition by new promoter Oilmax energy. In this business, the experience of management team matters most. The company is fortunate enough to have several pioneers and highly talented management team which create strong business moat for company.

The progress of this company left unnoticed due to business slump in 2019 and then COVID-19 situation in 2020 but now it is well set to give very good return in near future. The stock is trading at Rs.90 and it is giving best investment opportunity for one to three years. It can be bought within 15% from suggested price with 10% allocation in portfolio.