|

| CMP = 90 |

Asian Energy Services Limited (ASIAN) (formerly Asian Oilfield Services Limited) is an oil, gas and mineral industry service provider.

In May 2016, there was big turnaround in the fortune of this company came when Oilmax Energy has acquired the company from its previous promoter PE firm Samara Capital. In fact Samara capital has exited the company with loss due to lack of required experience in oil and gas exploration industry.

https://www.bseindia.com/xml-data/corpfiling/CorpAttachment/2016/11/677CD8C6_3193_447E_BF12_FC2C6FF88144_182627.pdf

Later on company has raised the fund by issuing preferential basis shares @ Rs 80 and Rs 165 to promoters and other public category individual investors.

https://www.bseindia.com/xml-data/corpfiling/CorpAttachment/2016/12/34CB24C7_A53F_49F6_ABF7_BBB0481E935E_123747.pdf

https://www.bseindia.com/xml-data/corpfiling/CorpAttachment/2017/3/dc356743-3255-4bb7-acdf-dd584fa96da7.pdf

Post takeover by Oilmax, Asian has diversified its service portfolio and start offering end-to-end services which extend across the entire upstream value chain, including Geophysical Data Acquisition, Production Facility EPC using the Build-Own-Operate-Transfer (BOOT) model, Turnkey Drilling, and production facility Operation and Maintenance.

The company is specialised in 2D and 3D seismic data acquisition and entire spectrum of seismic and related services including acquisition, processing and interpretation of seismic data. It has exclusive access to wireless technology for seismic data collection in India.

Investment Rationale

Asian has competitive advantage over its competitor on cost and quality. It also allow this company to protect and maintain its market share with good profitability. All over the world Oil and gas exploration is dominated by multinational companies like Schlumberger, Halliburton, Baker and Hughes etc. Asian is Indian MNC which is providing its services in several countries.

People are the biggest asset for this company which make the whole difference. Promoters and management team are having very vast experience in Oil and gas exploration industry with all major domestic and global companies. Company has healthy business relationships with its clients such as Oil and Natural Gas Corporation Ltd (ONGC), Oil India Ltd (OIL), Vedanta etc.

It has very dynamic board of directors which include industry legends like Dr. Rabi Bastia, a globally acclaimed geoscientist, has been the driving force behind the rapid advancement of India in the oil industry. He is best known for his discovery of the KG D-6 gas field, the second largest find in the country till date. In 2007, Dr. Rabi Bastia was awarded the Padma Shri. It is rare instance that one of India's top civilian awards being given to a private sector executive.

An incredible tale of innovations in the Oil Industry - Dr. Rabi Bastia

https://youtu.be/dr_jAvDmwAE

ASIAN has an impeccable track record of delivering projects on time and in a cost-effective manner, in some of the most challenging environments such as arid deserts, forests and steep mountainous terrains, all the way from deserts in Kurdistan to the wet, hilly, forests in Assam

ASIAN being the only company to offer 3D wireless seismic technology in the Indian market. It provides comprehensive global resources onshore seismic data acquisition. Cable-less recording technology point-receiver seismic hardware and software enables a full range of imaging services, from cost-effective exploration through to high-quality imaging and reservoir characterization.

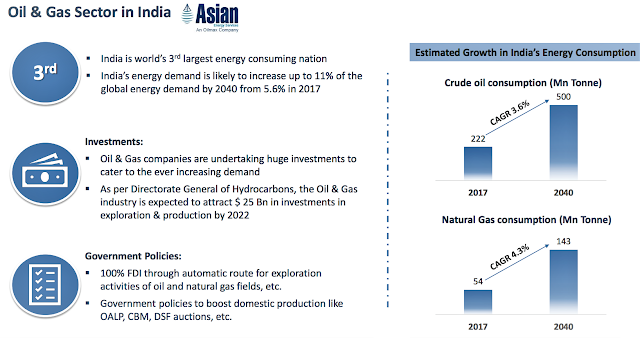

India is the world’s third largest energy consumer globally. The Indian Government has already unveiled of the National Seismic Program (NSP) to appraise the country’s reserves, the Indian seismic market has been expanded greatly with ~Rs 5000 Crore of work on offer.

Diesel demand in India is expected to double to 163 MT by 2029-30. Consumption of natural gas in India will increase by more than three-folds in next 10 years. The industry is expected to attract US$ 25 billion investment in exploration and production by 2022.

https://www.ibef.org/download/Oil-and-Gas-November-2020.pdf

The future for the O&M vertical look promising, with extensions on current orders and negotiation for more orders currently in the works. Even in a low oil price scenario, ASIAN should continue to see growth in the O&M vertical, as it specialize in being low-cost operators.

Asian has current order book of above Rs 1000 Crore Which gives fair business visibility for next three years. Even in dull market conditions order flow continues from major oil companies in India.

https://www.asianenergy.com/pdf/Investor-Relations/Corporate-Announcements/OtherCorporateAnnouncements/LOA-from-OIL-NC-Hills.pdf

https://www.asianenergy.com/pdf/Investor-Relations/Corporate-Announcements/OtherCorporateAnnouncements/BSE-Announcement-ONGC-Award%2026.10.2020.pdf

The company become debt free through repayment of corporate loans and outstanding liabilities, and to get rid of any deadweight, by selling off any non-strategic assets, to clean up its balance sheet.

Asian is run by a very highly qualified management team composed of industry veterans and pioneers, with an average experience of over 35 years working in the industry. The focus under the new management team is to be low-cost operation and maintaining the rigorous standards of quality and performance for its all services on offer. Going forward, company aims to switch from a capital-intensive business model to one in which it avoids owning assets where possible, to keep its capital risk as low as possible.

Expansion into offering other services like EPC, drilling, and decommissioning, is strategically focused on de-risking the revenue streams. Moreover, it allows the company to offer low-cost integrated management solutions to the Indian and international market.

Conclusion

Company has already made big turnaround within few years after acquisition by new promoter Oilmax energy. In this business, the experience of management team matters most. The company is fortunate enough to have several pioneers and highly talented management team which create strong business moat for company.

The progress of this company left unnoticed due to business slump in 2019 and then COVID-19 situation in 2020 but now it is well set to give very good return in near future. The stock is trading at Rs.90 and it is giving best investment opportunity for one to three years. It can be bought within 15% from suggested price with 10% allocation in portfolio.

Thanks mam

ReplyDeleteThank you Madam

ReplyDeletesurprised to see new stock suggestion, not on a weekend. Thank you madam

ReplyDeleteMadam, Thank you very much for this valuable stock idea.

ReplyDeleteThanks a lot.

Thanks for your suggestion and Explanation Madam. May I know what is wait time or hold time for this stock to reach 100%

ReplyDeleteHopefully It will give hundred percent return well within three years

DeleteThank you mam for the Reco.

ReplyDeleteThank you ma'am

ReplyDeleteThank you madam for new stock suggestions

ReplyDeleteJust excellent...

ReplyDeleteDear Blog members, learn from history and implement the learnings... That's all we need to do... Is very simple as mam explained many times in past

Thank you ma'am

ReplyDeleteMadam, is it correct kothari petro is going to start any big gas project?. Somwhere I road above info, please clarify and suggest accordingly hold or sell. Thank you.

ReplyDeleteThere is no any update given by company on Gas project.

DeleteYou can refer below post and comments

Deletehttps://dolly-bestpicks.blogspot.com/2021/01/investment-summary-past-performance-and.html

4) On average winning stock have given hundred percent return in 12 months but our expectation from every suggested stock is 100 % in 3 years. You can continue to hold free of cost share based on their performance for long-term five years or above for 300 to 500% return.

5) In normal condition, need to stick with our investment decision for 3 years. It means that if any non-performing stock unable to give at least 100% return in 3 years than we must take the decision to sell it and reinvest it again in some other stocks.

Even if free of cost stock not performing then apply above without any doubt.

Mam Balram Chainrai to whom warrants were issued 80 has reduced his stake at loss, i hope there is no negative

ReplyDeleteWarrants were issued at Rs.80 per share and Balram Chainrai has sold Around 12L shares to Prasoon Harshad Bhatt in between October 2019 to September 2020 at the price around Rs 100 to Rs.130 per share. he has not sold any share in between March - June 2020 or in Q1 during the market slump of COVID-19 when share price fall below Rs 80. Now Prasoon Harshad Bhatt total shareholding is 14.5L or 3.81% in the company.

DeleteThank you Madam for the new stock. May all good things happen to you for your tireless and selfless services in showing the right path to small investors.

ReplyDeleteThnk u mam for ur another pick . It would b very kind of u if u Please provide 1 IT sector stock, 1 pharma sector , 1 electrical vehicles sector stock .. . . Thnk u......

ReplyDeleteOk if we have any good option from above sectors then we will definitely go for it in coming months.

DeleteDear mam can you please advise how much more time we have to hold GP PETROLEUM to get 100% profit from suggested price. Thank in advance

ReplyDeleteI have already replied on same comment in previous post

DeleteThank you mam for ur valuable reply

DeleteThank u medam...can u pls advise Nocil at cmp..for 3years..thanks medam

ReplyDeleteYou can buy it in case of further correction around 15 to 20% for long-term investment only

DeleteThanks Ma'am

ReplyDeleteBuy kcp Ltd

ReplyDeleteCurrent price ?

You can buy It with expected return around 15 to 20% per year for long-term investment only

DeleteThank you madam, the stock looks good, however oil exploration isnt happening much these days, A very experienced friend of mine sees no future in it and companies are not hiring anyone. Biden is against fossil fuels as well. I am sure you would have considered these things but it would be good to get some understanding along those lines.

ReplyDeleteThere is big moat in this business. Oil and gas exploration is dominated by few companies like Schlumberger, Halliburton Baker and Hughes etc. They are the pioneer in this field and they are still maintaining their monopoly since beginning. it only depends upon personal experience so any company getting mining or exploration contract will hire only professional because it needs huge investment from initial survey to final output of oil or gas. Any unfavourable result will end in total loss of project.For example this company is having average 35 year experience of core management team and most of the people have worked with major oil and gas companies in India and across the world, this is the main reason company has made big turnaround just after acquisition by the new management team. They start getting several orders from all major company in India and even across the world. It happened only due to personal contact and experience. these people are best paid in industry.

DeleteThe average fuel consumption of US vehicles are three-time higher than Indian vehicles. It means that people are buying bigger vehicles in the US or EU which are having very low fuel average. US is the biggest Consumer of fossil fuel in the world. Still there is long way to go to replace conventional fuel completely with unconventional fuel.

Madam, I am holding chemfab, the previous post doesn't clarify should i hold it or sell it.

ReplyDeletethanks a lot

You can refer below post and comments

Deletehttps://dolly-bestpicks.blogspot.com/2021/01/investment-summary-past-performance-and.html

4) On average winning stock have given hundred percent return in 12 months but our expectation from every suggested stock is 100 % in 3 years. You can continue to hold free of cost share based on their performance for long-term five years or above for 300 to 500% return.

5) In normal condition, need to stick with our investment decision for 3 years. It means that if any non-performing stock unable to give at least 100% return in 3 years than we must take the decision to sell it and reinvest it again in some other stocks.

Even if free of cost stock not performing then apply above without any doubt.

Good morning madam, I bought IDFC before demerger @120/- 6/7 years ago, after demerger IDFC & IDFC first bank now both stocks are start their upward journey. Please suggest me can I book my investment amount or wait for IDFC first bank progress. Thank you.

ReplyDeleteI have already replied on same comment in previous post

DeleteThank you madam

DeleteThanks Madam for your valuable recommendation

ReplyDeleteDear mam'

ReplyDeleteWhat is view abt LT Foods-Daawat. Can we buy at CMP. Company is reducing debt gradually and few products is recent past. Posting good results continuously.

Regards.

DeleteYou can buy it in case of further correction around 15 to 20% for long-term investment only

Hi Mam,

ReplyDeleteThanks for the new recommendation, Oil (Petrol & Diesel) usage will be reduced in upcoming years due to the availability of Electric cars, you have mentioned that in 2029 - 2030 usage of diesel will be increased, also govt. has planned to scrap old vehicles from April 2022 and they are going to invest in natural gas for long hauling vehicles. Kindly share your thoughts. Will this be benefit for the recommended stock.

Thanks & Regards,

Hariram

consumption of fossil fuel is not going to reduce but growth will be less it will be below 5% in the next 20 years. Just now world has start thinking to replace it, still a long way to go to find any suitable alternate.

DeleteEven natural gas and mining need exploration which will never end. Still 75% of the world area is left unexplored so there is very huge scope for this industry. Twenty year period is fairly long time and we have done the investment only for three to five years.

Mam,little surprised with the stock suggest. Usually you prefer product based companies but 1st time I have seen service based company. To be frank looking into this type of company is new. What aspects to be looked in, how the OPM increases, what pushes the share price are the few doubts at my end. Calculating the overall industry and how much book order of this company with OPM will turn this company into multibagger. Pls help in understanding

ReplyDeleteNow world is recovering from COVID-19 slump. All business activities are going to be normal in coming quarters. Consumption of fuel and energy will go back it to its normal level and and start growing further. The crude oil prices are also going up and it is trading near to 52 week high level. This company will get maximum benefit of above mentioned activities because it is having monopoly in one of its business segment in India.

DeleteThere is big moat in this business. Oil and gas exploration is dominated by few companies like Schlumberger, Halliburton Baker and Hughes etc. They are the pioneer in this field and they are still maintaining their monopoly since beginning. it only depends upon personal experience so any company getting mining or exploration contract will hire only professional because it needs huge investment from initial survey to final output of oil or gas. Any unfavourable result will end in total loss of project.For example this company is having average 35 year experience of core management team and most of the people have worked with major oil and gas companies in India and across the world, this is the main reason company has made big turnaround just after acquisition by the new management team. They start getting several orders from all major company in India and even across the world. It happened only due to personal contact and experience. these people are best paid in industry.

The average fuel consumption of US vehicles are three-time higher than Indian vehicles. It means that people are buying bigger vehicles in the US or EU which are having very low fuel average. US is the biggest Consumer of fossil fuel in the world. Still there is long way to go to replace conventional fuel completely with unconventional fuel.

Dear Mam, Thanks for your stock suggestion.

ReplyDeleteYour insights on Prakash Industries. It will be helpful for us to take decision on the specific stock. Thanks!

Sorry not tracking the stock in recent time

DeleteMadam, we are very thankful to selfless service to us. My question is in this market correction where to invest in our old and new suggested stocks stocks. your opinion on TATA MOTORS for long term view. Thank you.

ReplyDeleteIt looks like you have not read previous post

Deletehttps://dolly-bestpicks.blogspot.com/2021/01/investment-summary-past-performance-and.html

Still have the chance to invest in below stock

https://dolly-bestpicks.blogspot.com/2021/01/asian-energy-services-limited-indian-mnc.html#comment-form

Not tracking Tata Motors

Thanks dolly mam for sharing the stock.

ReplyDeletePlease suggest some under valued & small cap stock from IT ,pharma & electric vehicles.

Usually, small IT companies(services) don't have any hedge compared with the large IT companies. Small IT company performance purely depends on promotors and management capability and their track record. Product IT companies are different, even small product company can be a differentiator in the market but I don't see any company in India apart from ZOHO which is not listed.

DeleteHappiest Minds - started by Mindtree founder. Good company but very expensive. For that matter, MindTree is also a good company with 27K m.cap still has a lot of scope.

In electric vehicles we have few listed options like Mahindra, Tata Motors, Amararaja, Exide etc

DeleteWe will consider pharma sector in this year

OLECTRA GREENTECH collaboration with BYD looks good as it has 40% electric bus market share in india

DeleteMam;Thanks for suggestion.Hoping your future suggestion may be from consumer or food processing field.

ReplyDeleteWe see it in coming months

DeleteMaam...nitin spinner has posted strong results. I will like to hold with conviction.

ReplyDeleteYour view?

You may continue with it but no change in previous view

Deletehttps://dolly-bestpicks.blogspot.com/2021/01/investment-summary-past-performance-and.html

Researh Report alert - "Global Vinyl Sulfone Market (2021) to Witness Huge Growth by 2026 | Bodal Chemicals, Kiri Industries, Shree Pushkar Chemicals, Bhageria Group, AksharChem India"

ReplyDeleteHopefully AksharChem India is in place make use of this opportunity.

Yes AksharChem will also get good benifit of it

DeleteMaam request your views on Trident

ReplyDeleteIt is good stock in textile sector you can continue to hold it for long term

DeleteMadam..apart from investing in blog suggested midcap/smallcap portfolio

ReplyDeletei want to stop my mutual fund investment and instead invest in 5-6 largecap each month in SIP mode for next 15 years. Can you suggest me 5-6 names?

I am not tracking any specific stock but you can go by top 5-6 market capitalisation

DeleteBased on budget in our recommendations any stock can buy madam.

ReplyDeleteBudget is good for overall market growth.

DeleteMadam, which stock is benefits after the scrap policy.

ReplyDeleteAutomobile sector will get maximum benefit

DeleteWhich stock is best for long term madam

DeleteMaruti, Mahendra, Tata Motors

DeleteHi Madam,

ReplyDeleteIs it good to enter Venkeys, Tata Consumer, Nucleus Software exports and Affle India at cmp?

These stocks are already moved lot in recent time

DeleteHi Ma'am

ReplyDeleteThanks for this stock suggestion. One doubt - This company is not giving out dividends. How do you see this aspect?

Company is accumulating some cash for future order execution so that it can avoid any debt in case of large orders

DeleteHello madam,

ReplyDeleteI am not able to see this stock in zerodha..

Sorry I don't have any idea about zerodha

DeleteSir, on Zerodha /Kite,search bar type ASIANENE, stock listed in BSE only

DeleteSearchg in BSE stocks , not in NSE

DeleteIt is there with name "ASIANENE" with BSE.

DeleteThank you for suggesting Deepak Nitrite, it turned multi-bagger and hitting new highs.

ReplyDeleteRespected sir

ReplyDeleteThank u for your personal help for small investors like us.

Sir, I have NR Agrawal at 269. Your suggestion on the stock based on current result. (Buy/hold/sell)

Thank you sir in advance.

You can continue to hold NR Agrawal for long turm

DeleteDear Madam, thanks for your valuable inputs.

ReplyDeleteYour inputs on Talbros Automotive Components Ltd. Thanks!

You can continue to hold it, in long run it can give decent return

DeleteIn normal condition, need to stick with our investment decision for 3 years. It means that if any non-performing stock unable to give at least 100% return in 3 years than we must take the decision to sell it and reinvest it again in some other stocks.

ReplyDeletemadam can i keep aditya birla fashion for long term ?? i have read all investment summery but i think this stock may be exception please reply regarding this waiting

It has given already 100% return, you can continue to hold free of cost shares for long term. At present textile sector still lagging and it may take few quarters more to catch the momentum

Deleteplease reply regarding jubilant industries todays results in detail whats the improvement from last 3 quarters waiting

ReplyDeleteJubilant industry has posted good result, there is significant improvement in top and bottom line. you can continue to hold free of cost shares for long term.

DeleteMam, heavy loss, more than 94% in Sintex plastics for the past 2 years. I invested around 25% of my portfolio there. Any ray of hope? Any strategy you can suggest considering the ill fate of the retail investors?

ReplyDeleteMost of the investment is already eroded, even after selling it at cmp you will get nothing so better to hold as it is and write off investment. Otherwise you will get always distracted with this thoughts

DeleteMadam, please throw some light on TATA MOTORS demerger in to two separate entities in to passenger vehicle and other one. Is it right time to buy or what level is right buy for next 20 years. Thank you

ReplyDeleteSorry not tracking it

DeleteMadam, Any views on Laurus Labs, Sequent scientifc and Neuland labs for long-term. Their earnings seems to be very good. But for last one year all these stocks ran almost 100-300% already. Do you still see value in them?

ReplyDeleteSorry not tracking these stocks.

DeleteMam, have already gone through results of dfcl and jk but just need your quick comments.

ReplyDeleteAlso, do you think if there is change in view of jk buying price for fresh investment... Or any change in view of jk for fresh investment? I really liked the business and your blog explanation on jk but missed to buy it due to insufficient funds

Deepak Fertilizer has posted very good result and it will improve for the incoming quarters. JK a agri has already given more than 200% return within one year and it is still trading much higher than suggested price. Nothing to worry for any lost chance because market is full of opportunity and it will give always better than previous opportunity for investment

DeleteMadam can I buy bharat gears ltd at current price.

ReplyDeleteIt is still trading below suggested price but its holding period is ending in September 2021. those who are holding should look for good opportunity to exit.

DeleteRajiv sir, your comments on Deepak fertilizer result and future prospects pls.also by when we can expect movement in stock price

ReplyDeleteDeepak Fertilizer has posted very good result and it will continue to give better result in future also. If any company giving continuously good result for 5-6 quarter then definitely price will follow it and it will go up.

DeleteDear Sir,

ReplyDeleteThank you very much for your valuable comment on DFPCL results.

Sir, what is your thoughts on their pledged share? As approximately, 75% shares were pledged.

Thank you sir for your kind and regular support.

In the past company has already given update on pledge shareholding and even in yesterday conference call the company has clarified on pledge shareholding that it is non disposable type pledge and given against investment of IFC

Delete(World Bank). it will be released once the conversion is done. The conversion price is 195 rupees.

dolly mam,

ReplyDeleteHow is tata chemical ? Can it be brought at current level (@525 INR per share)?

Sorry not tracking it

DeletePlease comment on KRBL stock as well .My average purchase price is 413 & holding 987 stocks .Current stock price is 200.

ReplyDeleteRecently KRBL director is arrested by enforcement director for 5 days .Company fundamental are good .Stock is undervalued and rice future is good.

I am holding stock from 3 year and averaging it by buying at lower price.

What shall I do ? Please suggest .Should I hold it further ?There is no requirement of money .I can hold it if it can perform in future. I think due to case against director stock might not be performing.

Current instability is temporary. You can continue to hold it but don't average it.

DeleteThanks mam for advise.Asking from learning prospective "why shouldnt average it ?"

DeleteNothing to worry for any lost chance because market is full of opportunity and it will give always better than previous opportunity for investment

ReplyDeleteliked too much... To be remembered forever

Respected madam,pl comment on ncl industries

ReplyDeleteIt is good stock to hold for long term

DeleteGood morning mam

ReplyDeleteI have som distillery since 3 yrs . It has been hammered after GST divergen by promoter. What to do? Please guide me on this. Thanks

Company has well-established portfolio of beer business and supply tie up with several CSD in country. You can wait for few months, once the stock price will go up that time u can exit from it because generally beer demand will go up in summer season.

DeleteMam, Your view on ADF foods results and It's future growth. Shall hold?

ReplyDeleteYes you can continue to hold free of cost share for further gain.

DeleteSir if I want to attend conference call of company, how can I attend that, from where will I get details, searched for tpl plastech but could not get any detail..

ReplyDeleteGenerally company send the invitation on your email registered with your Demat account . You can registered to attend the conference call as per given instruction. After that you can join the conference call on your mobile phone or video conferencing.

DeleteMam, your view on Welspun corp. Is it good for long-term investment?

ReplyDeleteSorry not tracking it

DeleteMadam, please throw some light on future prospects of "Dharamsi Moraji" chemicals which is having 100 years old company. Thank you.

ReplyDeletesorry not tracking it

DeleteMadam, this company has 100 years old and good growth in future. Thank you

DeleteMam, ABFRL has posted good set of Q3 numbers. What do you think about the stock over the next 1 year. I'm holding since your blog recommendation. Thanks

ReplyDeleteResult is good and it will improve further the incoming quarters. You can continue to hold free of cost share for long term. It will give consistent return and stability to portfolio.

DeleteMadam please suggest future prospects of TRIDENT for long term target.

ReplyDeleteIt is having good growth potential, you can continue to hold it for long term

DeleteDear Ma'am, Deepak Nitrite looks like it will become a large cap in next 5 years or so...

ReplyDeleteDoes Deepak fertilizer also have similar potential.

Yes Deepak Fertilizer will also give good return but it will also test the patience same like Deepak nitrite. It was trading around 300 for more than 2 years

DeleteMaam can I buy trident at current price

ReplyDeleteStock price has gone up more then hundred percent in last 30- 40 days so you can wait for some correction

DeleteDear Ma'am, pls give your comments on Akshar Chem n Asian Energy Q3 results?

ReplyDeleteBoth companies have posted good result for Q3 and it will further improve in coming quarters

DeleteHi madam,

ReplyDeleteWhen can we expect a good result from "JK agri genetics". Any update on the Ethopia bt cotton business..

Thanks,

Venkatesh

Covid-19 has significant impact on export business. Q1 is good for seed companies

DeleteMadam , Green panel industries "GIL" is showing good sales growth and net profit @ 38% since last 4 quarters please suggest accordingly if it will fulfill in your criteria to become a future multi bagger. Thank you.

ReplyDeleteSorry not tracking it

Deletemadam, i am eligible for FOC in Balaji amines. can i start selling partial portions or wait for some more time?

ReplyDeleteSorry not tracking it

DeleteSir, Asian Energy result, top line has improved from 20 cr (last year) to 32 cr, bottom line at -96 lac against 1.21 cr last year...oil field service related expenses went up fm 8 cr to 22.48 cr...how should we read this result?

ReplyDeleteAlways read consolidated results for companies with subsidiaries or joint ventures. Prefer annual result for service providing companies because most of the time these companies get payment settlement during FY year end.

DeleteDear Ma'am, Recently companies like ATUL and The Anup Engineering have announced Open Market Buy Back Scheme?

ReplyDeleteWhat could be the objective behind such a move of doing Open Market Buy Back?

If you could help us understand the mind set of the promoters, it will help us great deal in learning.

Buyback offer is generaly for utilising the free cash of the company, it will also improve the financial ratios like EPS, dividend yield,ROE,ROCE etc.

DeleteIt will also give the option to increase or reduce the promoter shareholding.

Madam, Thanks for sharing your knowledge, I am holding Chambel fertilizer shares since long can we hold for long or we can book profits and exit . I bougth at 60 rs .

ReplyDeleteSorry not tracking it

DeleteHello Mam/Sir,

ReplyDeleteThanks for suggesting Deepak Nitrate. Made decent returns on this, still holding for decent returns in future.

what is your comment on Asian energy Q3 results.

when is going to be our next stock recommendation. Expecting a blaster like Deepak Nitrate, which can given very good returns in short term (1-2 year) and also long term (3-4 years).

Warm Regards,

Generally one out of 10 stock will able to give around 10 fold or higher return. We have found some stock in the past and we will able to find similar stocks in future also.

DeleteRespected Ma'am, pls give your comments on GP PETROLEUM Q3 results?

ReplyDeleteGP petroleum has posted good result, need to keep looking for good opportunity to exit on higher price in Coming months.

DeleteAsian Energy has given negative financial performance for quarter Dec 2020. I have purchased 350 shares @ 95.5 . CMP has fallen to 92. Please advice.

ReplyDeleteAlways read consolidated results for companies with subsidiaries or joint ventures. Prefer annual result for service providing companies because most of the time these companies get payment settlement during FY year end.

DeleteInvestment in stock market is subjected to significant risk. If you are not aware of it and not ready to take the risk then better to exit.

I could not purchase Asian Energy Services at the time it was recommended.With the quarterly result declared the stock price has gone down.Is it advisable to buy it now.

ReplyDeleteYes you can buy it

DeleteMadam, we are very proud of your knowledge and foresight to identify the multibagger stocks like Deepak nitrate. After 3 years of DNL stock suggestion, now all the tv channels and you tube channels are DNL is future multi bagger. Talbros auto forum in money control discussing regarding your fresh entry in Talbros auto. Is it correct? What is right entry price and time to enter to Talbros auto. Thank you

ReplyDeleteYou can continue to hold both stock for long term. Stock price has moved up significantly in recent past so it is not advisable to buy at current price. It is good that people start buying much higher then your purchase price, in fact your holding of these stocks are free of cost.

DeleteMadam, how to take part in conference call of Deepak nitrate on today I.e. 26.02 and ptovide phone number if possible. Thank you.

ReplyDeleteCompany has already send the invitation to existing shareholders on their registered email. Just need to to registered as per given guideline and follow the instruction

DeleteYou can use screener.com for easy information about any particular co.

DeleteMadam, please throw some light on DNL concall. 2. My buy price on TPL Plastic @ 290/- is it right time to buy more for average. 3. Kanpur plastic future growth. 🙏

ReplyDelete1. DNL is still having huge growth potential and it will continue to give strong results in coming quarters. Just hold it patently for another 3-4 years

Delete2. If any stock not performing for three years then we should start thinking on it and looking for best the possible chance to exit and reinvest it again.

3. Sorry not tracking Kanpur plastic

Madam your suggestions on fresh entry on vodafone idea and trident limited

ReplyDeleteSorry not tracking Vodafone, you can enter trident around 7 - 8 rupees for long term investment only

DeleteDear Maam, can we buy NCL industries at current price?

ReplyDeleteYou can buy this stock in case of some correction because most of the stocks have gone up significantly in recent time

DeleteDear Madam,

ReplyDeleteI hold Ganesh Housing at an average price of ₹75, incurring around 40% negative. Shall I accumulate at cmp to minimise my loss and exit later?

Please advise

Best regards

VST

You may continue to hold but we stop tracking non-performing stock after monitoring it for three years on the blog.

DeleteIf any stock not performing for three years then we should start thinking on it and looking for best the possible chance to exit and reinvest it again.

https://dolly-bestpicks.blogspot.com/2021/01/investment-summary-past-performance-and.html

Thanks for your advice Madam.

DeleteRegards

VST

Madam please throw some light on "NEOGEN CHEMICALS" and output of DNL concall. Thank you.

ReplyDeleteDNL is still having huge growth potential and it will continue to give strong results in coming quarters. Just hold it patently for another 3-4 years

DeleteSorry not tracking Neogen Chemicals

Hi Mam,

ReplyDeleteI would like to share my Joy with all bloggers that

I invested 1 lakh in DNL bought @ 238.44 (invested highest amount among all blog stock) and booked my profit today.

No words to describe madam, lots of experience in this last 6 years almost all my investment gave me 80 to 100% return, though not invested in all the blog stocks except NITIN and Kesoram where i started slowly exiting as per our previous blog suggestion.

started investing the money in asian energy services now mam.

Congratulation

DeleteHi Mam,

ReplyDeleteNeed your suggestion on to sell below stocks to fund coming blog suggestion stock. All these stock are old holdings. Need your suggestion on which all stocks should get rid of looking at their future prospect.

Future consumer @ Rs. 35 (-77%)

Future e enterprise @ Rs. 27 (-60%)

Dwarekesh sugar @ Rs. 61.5 (-55%)

KTKBANK @ Rs. 126 (-48%)

AMARJOTHI @ Rs. 157.5 (-38%)

Nandan Denim @ 49.4 (-41%)

Om Infra Ltd @ 47 (-48.6%)

Textile and infra sector will perform in Coming quarters , you may continue to hold related sector stocks for another few quarter and exit in positive market

DeleteRespected Sir,

ReplyDeletePlease share your view for Associated Alcohols for long term.

It seems very impressive, almost nil debt and good ratios. Again, as a small cap stock, it has given almost zero return since 3 years.

Is it advisable to add this stock to the portfolio?

Thank you in advance.

Yes it is good stock for long term investment and investment can be done in case of further correction

DeleteDear sir/ mam, thanks a ton for DNL . Entered at 240 sold some at 500 and holding 90% of stocks till now. 450% up from entry price . What a recommendation. Following your foot steps and becoming wiser by learning from your writings . I am a fan of yours. Rgds and pranam Deepak

ReplyDeleteDNL is still having huge growth potential and it will continue to give strong results in coming quarters. Just hold it patently for another 3-4 years

DeleteMadam, please throw some light on varun beverages future prospects after lockdown. 🙏

ReplyDeleteSorry not tracking it

DeleteMadam, when will be the next stock suggestion.can we accumulate the Deepak fert at CMP, will it give like Deepak nitrate in next 3 to 5 years?

ReplyDeleteNeed to follow the investment guidelines mentioned in below post

Deletehttps://dolly-bestpicks.blogspot.com/2021/01/investment-summary-past-performance-and.html

Mam, hupe we will see similar returns from deepak fertilizers in next 3-4 years.

ReplyDeleteKindly keep updated about progress and view on this stock as well

Sure, we will monitor it closely.

DeleteDisclosures of reasons for Pledge of shareholding by promoter of Deepak Fertilisers (DFPCL)

Delete1) Acquisition of equity shares of Deepak Fertilizers and Petrochemicals Corporation Limited (18-02-2021)

https://www.bseindia.com/xml-data/corpfiling/AttachLive/6C26C977_6F70_4D4C_8A1D_507FEDFF3BC2_131052.pdf

The promoters have intent to acquire DFPCL shares from open market. Earlier pledge was to subscribe in the right issue.

God bless you mam... Only few words for your work

DeleteMam, seems like market was unable to conclude if this is positive or not... Can you share your thought

DeleteMadam, before lockdown one of my d.mat account having only your recommended stocks showing negative return, after lockdown is showing @ morethan expected return. Second d.mat having business TV recommended stocks showing same return almost before / after lockdown. We are very thankful to your selfless great services and correct guidance to small investors. Now all TV / youtube channels are recommending DNL. Now my question on SBI and MARICO. Marico is aggressively introducing FMCG goods like honey and noodles. Honey brand is successful in market. If possible add to your track list for future recommendations. On SBI now giving tgt @ 800/- . Please suggest accordingly suitable action plan for the both companies. Thank you 🙏

ReplyDeleteStrategy of brand extension to expand the product portfolio in FMCG companies are very common. Tata consumer, Marico and Adani Enterprise are transforming itself into complete FMCG company from single or few products. MARICO is already well established brand in Personal Care.

DeleteNot tracking SBI and MARICO

Respected madam, what cane be the reason for the recent fall in Aksharchem prices... Your view on long term investment in this counter..

ReplyDeleteThere is no specific reason but stock correction is in line with market correction.

DeleteMadam, Do you track Fermenta Biotech Ltd?

ReplyDeleteYes

DeleteMadam, please suggest if we can buy at CMP? Please consider pharma/chemicals companies for next recommendation if anything is in the buying range and how do you see the run-way for these companies for next 5 years, especially after COVID, seems to be some positive developements on pharma/chemical industry.

DeleteCompany is having single product portfolio which is very risky. Due to same reason it has not participated in Pharma sector rally. You can invest small amount in case of 10 to 15% further correction. In general after any pandemic people become health-conscious and demand of Pharmaceutical products will remain high.

DeleteMadam, I have been invested in Deepak nitrate, currently with the latest value it is occupying 25% of total portfolio. i have taken out 2/3 of capital invested. Initially i have allocated good percentage and it has grown now to 25%. Little concerned now whether to continue or trim the allocation. DN has good future, can i keep the all shares as it is with 25% allocation. Please guide on this. why I am asking is, it should not happen like cutting down froots giving tree early. Please advise

ReplyDeleteIf Someone find the Diamond then it must not be sold at cheep valuation.It should not be exchanged for stones or raw diamond because it is time taking process for formation of diamond. For finding the diamond is very difficult and costly process.

DeleteDeepak nitrate has just started its journey and it is still having huge growth potential. it will continue to give strong results in coming years. Just hold it patently for another 3-4 years to see its true valuation.

very well said, recovered mostly all my losses and made profit also from DNL and ADF.

DeleteMadam, any special news in DNL concall, where to check the outcome of the same. Thank you

ReplyDeleteCompany will submit the transcript of Q3 earnings conference call on both stock exchanges within week.

DeleteDear medam, when will the next recommendation be posted? Thanks so much for your guidance. Take care medam.

ReplyDeleteMost probably it will be in the 3 or 4th week of March

DeleteDear mam,

ReplyDeleteCan we make fresh investment in Talbros Automotive Components Ltd. (share price is 219).Please confirm

Fresh investment at cmp is not advisable

DeleteNeed to follow the investment guidelines mentioned in below post

https://dolly-bestpicks.blogspot.com/2021/01/investment-summary-past-performance-and.html

Dear Madam, Can u pls do share ur view about Aurobindo Pharma at CMP. It's decently valued compare with its peers.

ReplyDeletePls do suggest whether we can buy Fermanto Bio at CMP?!!

Do u hv any value stock suggestion in Pharma segment.

Thanks & Regards,

Gajendrakumar

Sorry not tracking Aurobindo Pharma

DeleteFermenta is having single product portfolio which is very risky. Due to same reason it has not participated in Pharma sector rally. You can invest small amount in case of 10 to 15% further correction.

We will go for Pharma sector stock in coming months

Mam,Any view on Blackrose Ind & wimplast.

ReplyDeleteThanks.

Dear Sir/Madam, Going through your previous thread summarizing the performance, I wondered if it would be a value bet now to enter some of the counters which are in deep red (Bharat Gears, GP Petroleum, Ganesh Housing, TPL) where you still have 'Hold' recommendation. I assume you recommend holding because the investment theses has a reasonable chance of playing out? Would you suggest these stocks are now even more attractive than they were when first recommended?

ReplyDeleteThank you for your time and advise.

Regards,

Ravi